- Preface

- Insurance: Meaning and Definitions

- Features and Nature of Insurance

- Assurance and Insurance

- Principles of Insurance

Risk is ubiquitous, today everyone is surrounded by risks. Whether it is the owner of a big industrial empire or a small shopkeeper, professional person, sportsperson, politician, actor, farmer, laborer, scientist, everyone is surrounded by some or the other uncertainty. Some are concerned about their body and health, some are concerned about their heirs after death, then some are concerned that their property may not be destroyed by fire, wind, water, disturbance, earthquake etc. The employee is concerned about the job, the employer is concerned about the betrayal by the employee, the partners are concerned about the money-grabbing by the other partner. A rich person is concerned about wealth, while a poor person is concerned about lentils and roti every day. The businessman is concerned about the competitor, as well as the timelessness of the goods. The consumer is concerned that he is not being given adulterated or counterfeit goods. These worries make a person prone to risk and also create uncertainty in life.

That’s why Fank H. Knight’s statement is absolutely true that “Risk is the name of uncertainty and uncertainty is one of the fundamental uncertainties of life.”

Insurance is not a funny word, nor is it a matter of quackery. This is very important to secure a sound financial future. Insurance makes a person’s thinking positive, that even if something happens to him in the future, he is protected by insurance. It is certain that the future cannot be known or controlled, but it can be secured by insurance.

It is the nature of man that he wants to protect himself. From the primitive age to the present, man has been taking many measures to reduce his uncertainties and risks. One of those measures is insurance. Insurance is becoming a necessity for everyone, society, business and nation. It is difficult to even imagine modern development without insurance.

Calvin Coolidge of America has expressed his views that insurance is that modern means by which the uncertain can be made definite and the unequal equal, it is the means by which success can be almost certain. Through this, the strong contribute to the help of the weak. The joint family system also provided protection similar to insurance, but at present due to industrialization the joint family system is disintegrating, so this responsibility is being fulfilled by insurance only. In short, it can be said that insurance is concerned with the risk or apprehension of damage. Various types of risks can be avoided through insurance because insurance provides protection and protection from the ill effects of risks.

Scholars have defined insurance from several perspectives. Sociologists have considered insurance as “social security”. Scholars related to the economic world have defined it as process-oriented. Scholars having a legal point of view have given legal definitions of insurance, so on the basis of these different perspectives, the definitions of insurance have been divided into three parts.

1. General Definitions – These definitions have been given by various sociologists and general public.

According to Sir William Beveridge, taking risks collectively is insurance. “In this definition, on the basis of sharing the risk and the spirit of co-operation, the main function of insurance is to provide protection to the general public from the risks. According to Magee, insurance is the plan under which a large number of people come together to protect the risks of a single individual. carries it on his shoulder.”

In this definition the organizational basis of insurance is presented. Each person takes the risk of another person on himself i.e. everyone in the group helps him when he suffers a loss.

According to Boone and Kurtz, insurance replaces a large unknown loss, which may or may not happen, with a known small loss.

In this definition, the uncertainty of loss, the assessment of risk and the determination of loss, the process of insurance and the process of determining the payment amount of insurance, that is, the future uncertain loss is determined in the present by the premium amount, has been described.

General Definition – Insurance is a social and cooperative way of taking risks, in which individuals with similar risks transfer their risks to another person or an organization (insurer) or take them collectively.

2. Functional Definitions – These definitions refer to the process of insurance. According to the Federation of Insurance Institute, Mumbai:- “Insurance is a method in which persons with a similar type of risk contribute to a common fund, out of which some unlucky persons Losses caused by accidents are covered. In this definition, the insurance process has been clarified in the institutional form that different groups of persons are made to be surrounded by different types of risks and the contribution (premium) is paid by all the group members, if any member of them suffers a related loss. But the payment is made from that fund.

According to Regal and Miller, “Insurance is that social measure or scheme by which the uncertain risks of individual individuals can be linked with those of a group. The losses of the losers out of the funds created out of small contributions made by all the individuals from time to time.” This definition defines the organizational nature of insurance. Premiums are paid from time to time in that fund by persons exposed to similar risks. From the corpus made up of premium, the risk affected person is compensated for that loss.

General Definition – In insurance, persons with similar risks come together under an organization and contribute towards protection, so that in case of risk arising, it can be paid to the person at risk from that fund. These definitions explain the working of insurance.

3. Statutory Definitions – These definitions explain the legal nature of insurance. According to Regal and Miller – Legally, it is a contract in which the insurer agrees to meet the insured for the financial loss arising within the scope of the contract and the insured also agrees to pay the consideration for it. ,

This definition explains the contractual nature of insurance. In this, one party (the insurer) promises to meet a certain loss and the other party (the insured) promises to pay a certain amount of consideration (premium). After studying various definitions, it can be said in conclusion that insurance is a group of persons surrounded by similar types of risks, in which a certain amount of money is paid to any person from the fund created by their contribution when the risk arises. goes .

General Definition – Insurance – is a contract between the insured and the insurer in which the insurer promises to pay a certain sum of money in exchange for a fixed return on the occurrence of the events mentioned in the insured’s letter of insurance.

Based on the study of the definitions of insurance, the characteristics of insurance are being analyzed, which also explains the nature of insurance:

- Risk Protection – Insurance is a powerful way to protect against risks. Makes a person free from all the uncertainties prevailing in life. These risks may relate to life, health, rights and financial resources, assets. Therefore, one way of protection against all these risks is insurance.

- Method of Spreading the Risks – In insurance, “one for all and all for one” work is done on the basis of cooperative spirit. A fund is formed by aggregating persons with similar types of risks so that the risk of one person is distributed among all the members and when the risk arises to any one member, that particular member is paid from that fund.

- Transfer of risk from the insured to the insurer – In insurance, the risks of all the insured are transferred to the insurer. A fixed payment is made by the insurer in case of loss to the insured.

- Insurance is a process – Insurance is also a process which is conducted in a predetermined method. First the insured transfers his risk to the insurer in exchange for a fixed premium, then the insured is protected against that risk by obligation. She goes .

- Insurance a contract – Insurance having the property of legality, it is a valid contract. In this, an offer is made by the insured to the insurer and on acceptance by the insurer, a valid contract is made between the two in exchange for a fixed return (premium). In which the insurer promises to cover the loss on the occurrence of a certain event.

- Insurance is a cooperative approach – Insurance is based on the spirit of cooperative. Persons exposed to similar types of risks contribute to a certain fund, out of which the risk to any member is paid out of that fund. Thus works on the spirit of “all for one and one for all”.

- Risks are transferred by the insured to the insurance company and the value of that risk is fixed with a fixed return / premium. That is, in lieu of fixed premium, uncertain losses are determined as the sum insured to be received by the insurance company. This amount is called the insurance claim amount.

- Payment only on the occurrence of the event – In insurance, the payment is made only on the occurrence of the event. In life insurance, the event is certain to happen, such as the death of a person, suffering from a particular disease, completion of the insurance period, then in such a situation, the insured must pay. But in normal insurance, payment will be made only after the occurrence of the event, otherwise the insured will not be considered liable for payment.

- Assessment and assessment of risk – In insurance, the assessment of risk is done before the contract of insurance. The premium is predetermined based on the amount of risk and the likelihood of the risk arising. In lieu of this fixed return/premium, a certain sum assured is paid on the occurrence of a certain risk.

- Basis of payment – There is an investment element in life insurance, so on the death of the party or the completion of the term, a certain amount is paid to the insured. But in other insurance the payment will be made equal to the actual damage. This damage will be paid only in case of risk arising due to the insured reasons and within the limit of the sum insured as per the contract, not more than that amount will be paid.

- Wide Scope – The scope of insurance has now become very wide. Earlier only life insurance, marine insurance and fire insurance were insured, but now along with traditional risks, non-traditional risks are also insured. Now the scope of miscellaneous insurance has become very broad. In this, many types of insurance have been included like theft insurance, accident insurance, livestock insurance, crop insurance etc.

- Institutional Structure – Large organizations all over the world are engaged in insurance work. In India Life Insurance Corporation, General Insurance Corporation and its four subsidiaries and many private companies are engaged in the work of insurance.

- Insurance is not gambling – In insurance, compensation is compensated only when there is a normal loss equal to the actual loss, so it is wrong to compare insurance with gambling. In gambling, one party is in profit and the other party is always in loss, but in insurance this does not happen.

- Insurance is not a donation, it is a right – the right is obtained by contributing to the insurance by the insured, on the basis of the contractual relationship, the insurer pays the insured money / claim after a certain period of time in return for the fixed consideration (premium).

- Measures to solve social problems – Many social problems prevailing in the society are solved by insurance because the uncertainties and risks of the society are reduced by insurance.

- Insurance Law Compulsory – In the modern era, the field of insurance is expanding, along with it it is becoming the duty of the governments to make regulatory acts related to insurance. Acts have been made in India also for life insurance, marine insurance, general insurance. Apart from this, the entire insurance business is regulated and controlled by the “Insurance Control and Development Authority”.

- Essentials of Insurance Principles – It is necessary to have certain principles for the insurance contract, among which insurable interest, principle of ultimate good faith, cooperation and potential etc. are the main principles. In the absence of the principle of insurable interest, insurance will be treated as gambling.

- Only legitimate properties/works can be insured – Only legitimate properties can be insured. Goods of theft, dacoity, smuggling etc. cannot be insured.

- Having Large Number of Insureds – The larger the group of persons exposed to the same type of risk, the more the insured will get protection in return for a lower premium.

- Loss is beyond the control of the insured – Only unknown and uncertain losses can be insured. Whether the loss will happen or not, what will be the intensity and intensity of the loss, it should all be out of control.

- Assurance – The term is used for those insurance contracts in which the liability of the insurer is fixed. The insurer will pay the insured a certain sum of money on the occurrence of a certain event or the completion of a specified period. This term is often used for life insurance. There is an appropriation element in it.

- Insurance – The term is used for a contract in which the possibility of risk is revealed but the certainty is not revealed. The same term is used in indemnity contracts. Used for all insurances especially fire, marine and special insurance contracts. The insurer will be liable for damages only if there is damage, otherwise no amount is liable to be paid. The word insurance is also used for life insurance. Now only the word insurance is prevalent in India.

There are some basic and legal principles of insurance. Which is necessary to follow –

1. The principle of supreme good faith – Like all contracts, there must be utmost confidence in the contract of insurance also. Good faith means that the insured, while insuring, should disclose all those facts which have a bearing on that contract, that is, the facts on the basis of which the insurer may accept or reject the offer of insurance, determine the premium or impose certain conditions or decide not to. That is why facts like age, height, weight, physical structure, occupational nature, personal habits like smoking / drinking and family history, medical history, insurance taken before surgeries etc. are considered important in life insurance. In fire insurance the structure of property, nature of goods, condition of warehouse, nature of work etc., in marine insurance the size, design, machines, accessories, nature of goods, packing method of goods etc. and condition of vehicle in accident insurance, In theft insurance, the condition of the warehouse, the arrangement of security, the nature of the goods, etc. are considered important. In ordinary covenants, the rule “Buyer beware” applies and there is no obligation to disclose everything regarding the subject matter. But in insurance covenants, this rule does not apply but the rule of trust applies. If either of the parties has made misrepresentation, disclosure or suppression of a material fact, the rule of best faith is breached and the contract of insurance may be void.

The main features of the doctrine of supreme trust

- The principle of utmost good faith applies to both the parties to the contract of insurance

- The principle of utmost good faith applies equally to all insurance contracts.

- The insured must disclose all the facts and circumstances which he or she should be aware of under normal circumstances.

- It is not the duty of the insured to think about any fact whether it is important or not, he should disclose everything which is known to him by the facts or circumstances.

- All such facts or circumstances should also be disclosed which may be important for the future.

- The insurer should also inform the insured of all the matters relating to the contract which may affect his insurance decision.

Facts which are important but not required to be disclosed –

- Facts related to general knowledge, which are expected of every person.

- Information relating to legal facts.

- The facts that will be known from the survey.

- Those facts which can be easily ascertained from the past policies and records available with the insurer.

- Facts which are unnecessary or the insurer has not asked for the information.

- Facts which are in the nature of public information.

- Facts already known to the insurer.

- Factors that reduce the risk, such as the installation of fire extinguishers in fire insurance, etc.

However, in the contract of insurance, both the insured and the insurer have an obligation to act in full confidence. But the insurer being the party taking the risk, the liability to show confidence on him is reduced. No one knows more about the subject matter of insurance than the insured, so it is the responsibility of the insured to clarify all the important facts related to insurance.

Effect of concealment of important facts – The principle of utmost confidence has an important place in every type of insurance contract. If a party knowingly suppresses any material facts with respect to the subject matter of insurance, then the contract of insurance becomes void. Lord Blakevarn, while adjudicating a dispute, said that “the concealment of any material circumstance of which you have knowledge, whether you consider it important to conceal it or not, voids the insured.” But if any fact is ignorance or accident. If the reasons are not disclosed, the contract is voidable at the will of the aggrieved party.

Period of disclosure of facts – It is also the duty of the insured to inform if there is any change in facts and circumstances after the insured has made an offer of insurance, but even before the contract is entered into. Important facts should be disclosed by the insured at the time of making any change in the policy of insurance, even at the time of renewal. If any explicit conditions have been given in the insurance letter, then the insured will be bound to inform about the significant changes that may take place even after the contract is signed.

Similarly, if there is a condition in the letter of insurance, the meaning of which is not certain, then it is the duty of the insurer to explain that condition.

II Principle of Insurable Interest – A very important and fundamental principle of insurance is the principle of insurable interest. The validity of an insurance contract requires that the insured has an insurable interest in the subject matter insured. An insurance contract without insurable interest would be an arrangement of gambling which is expressly declared void under the Indian Contract Act 1872 and in such a case no amount can be obtained from the insurance company.

(i) Meaning and definition of insurable interest – In simple words, insurable interest means that when a person gets a pecuniary benefit due to the continuance of the subject matter of insurance and he suffers pecuniary loss due to its destruction, then it is said to be that that person has an insurable interest in that article.

According to Regal, Miller and Williams Jr. – “Insurable interest is an interest of such nature in which the occurrence of the event insured would cause pecuniary damage to the holder of the property.”

According to Section 7(2) of the Marine Insurance Act – “A person is said to have an interest in a collective adventure when he holds a legal or just position in respect of any adventure or insurable property at risk of which As a result, safe return of the insured property benefits him and loss, damage and withholding thereof causes loss or any liability to him.From the study of the above definitions we come to the conclusion that insurable interest means insurance. in the subject matter of the insured’s pecuniary interest in which he would benefit from the protection of the subject matter of insurance and any pecuniary loss or liability caused or could be prejudicially affected by loss or damage to that subject-matter.

(ii) Characteristics of insurable interest –

- The subject matter to be insured, such as life for life insurance, • To insure the property, it is necessary to have any property, right, interest or potential liability.

- The insured has an economic interest in the object, emotional, spiritual ( Worry, sorrow, happiness etc. or the interests related to affection, love are not called insurable interests.

- The insured should have a statutory and close relationship with the subject matter of insurance. Illegal interests are not insurable.

- There should be financial loss on the loss or death of the insured subject and there should be financial gain if it is safe.

- Insurable interest must be ensured so that it can be measured.

- The principle of insurable interest is applicable in all types of insurance contracts.

- In life insurance, insurable interest is necessary at the time of being insured and it is not necessary to continue thereafter.

- There must be an insurable interest in making a claim for indemnity in marine insurance.

- There must be an insurable interest in fire insurance and accident insurance both at the time of insurance, and at the time of loss or claim for compensation.

III. Limit of insurable interest – There may be different limits of insurable interest in different types of insurance contracts, an example list of which is given below,

(a) Limit of insurable interest in life insurance –

- An individual is considered to have an unlimited amount of insurable interest in his own life, but the insurers accept the offer of insurance only in proportion to the means of income of the insured.

- Spouses have an insurable interest in each other’s life. “In family relations, even if there is closeness and blood relations, it is considered insurable interest and the parties can get each other insured, but it is also necessary to prove that the other party gets financial benefits if he lives with the party and does not stay with the other party. There should be loss i.e. the existence of family and blood relations alone does not generate insurable interest law, it is necessary to prove it. ” , “In fact, in India, the provisions regarding insurable interest of parents in the life of children and of children in the life of parents are not entirely clear. In the field of life insurance, proposals are accepted from the parents for the insurance of children.”

- A lender has an insurable interest in the life of the borrower to the extent of the loan.

- A partner has an insurable interest in the life of other partners or co-partners equal to the capital employed by him.

- A company’s insurable interest in its employee extends to a condition affecting the profits and position of the company upon his death.

- A servant who is employed for a specified period shall have an insurable interest in the life of his employer.

- An employer also has an insurable interest in the life of his employee. Group insurance is done on this basis.

- The principal of the surety is found to be an insurable interest in the life of the debtor to the extent of the guarantee given by him.

- Similarly, the agent’s interest in the owner’s life, a landlord’s in his farmer’s life, the depository’s in the life of the depositor are considered to be insurable.

(b) Insurable interest in fire and other general insurance –

- The owner of the property to the extent of its value in the property and the profits to be derived from it.

- The co-owner of the property up to his share in the property.

- To the extent of the mortgage of the property in any property.

- In the case of contracts, to the extent of profits derived from any contract. Example – In a building rental contract, the insured has an insurable interest to the extent of the rent.

- The agent has an insurable interest in the property of his employer.

- A trustee has an insurable interest in the property trusted in his own right.

- The depositor has an insurable interest in the goods deposited with him.

- The insurer is also found to have an insurable interest in the risks insured. Example reinsurance.

- Insurable interest is found to the extent of the liability that may arise at the time of insuring for a statutory liability.

- In the event of a contractor hiring machinery and equipment at his own risk in construction work, insurable interest arises, so he can get insurance for liability towards these and third parties.

(c) Insurable interest in marine insurance –

- The owner of the ship, the owner of the cargo and the hirer have insurable interest to the extent of their respective values.

- The owner of the ship has an insurable interest in his liability to the goods in the ship.

- The owner of the ship can also get liability insurance for third parties’ damages.

- The mortgagee, the depositor and the trustee have an insurable interest up to their own amount.

- The company insuring the ship has an insurable interest up to the amount insured.

- The hirer of the ship is insurable to the extent of the value of the ship.

(iv) The need and importance of insurable interest –

Insurable interest is necessary due to the following reasons.

- Basis of validity of insurance – Insurance contract is valid only because of insurable interest. In the absence of this, it will become useless and will also be considered against public policy.

- Basis of indemnity – It is decided only on the basis of insurable interest that how much damage has been caused to the person. Is .

- Protection of property and life of other people – In the absence of insurable interest, any person can get any property or life insured, and himself will think of getting a claim by destroying that property / life. This will increase the risk to life and property. Therefore, it is necessary to have an insurable interest in insurance for their protection.

- Prohibition on gambling – In the absence of insurable interest, the insurance arrangement will become like gambling, so that without any interest in the security of the subject, they will be interested in earning profit from it, even if that profit is obtained only by destroying the object. Would have happened Thus preventing the illegal tendency of making huge profit in return for a small premium in the cause of insurable interest.

III. Principle of Assurances –

Insurance contract depends on the performance of assurances. If the parties do not comply with the assurances given by them in the insurance contract, then the success of the insurance contract will remain doubtful. The terms and details added in the insurance letter are called assurances.

According to Section 35 of the Indian Marine Insurance Act, 1963, “Assurance” means an undertaking by which the insured gives an undertaking that a particular act will or will not be done or that certain conditions will be fulfilled or by which the existence of any fact accepts or rejects.In other words, assurance is a promise made by the insured assuring whether a certain thing will happen or not, whether a certain condition will be fulfilled or not.

For example, insuring non-flammable goods kept in a godown shall be deemed to be an assurance by the insured that inflammable goods will not be kept with it as such goods will increase the risk.

(i) Characteristics of Assurances –

- Assurance is an integral part of the contract of insurance and on which this contract is considered to be based.

- Assurance is a statement of acceptance and promise of the insured, which is related to doing or not doing any work or fulfilling any condition.

- The facts don’t have to be important. In the context of risk, even seemingly insignificant facts can be assurances.

- Assurances can be explicit or implied. Explicit assurances are those which have been made clear in writing in the letter of insurance, whereas the creation of implied assurances apply to the parties by the conduct or behavior of the parties or in accordance with the provisions of the Act. They are not mentioned in the insurance letter. Heated assurances are of no importance in other types of insurance other than marine insurance. Marine insurance has the implied assurance of

- Passenger insurance as an assurance of a ship’s seaworthiness

- The goods being loaded onto the ship will also be “seaworthy”.

- The subject matter of insurance is valid.

(ii) Consequences of Breach of Assurance – The assurances given in the insurance contract have an important place. The validity of the insurance contract depends only on the fulfillment of those statements. As per Section 35(3) of the Marine Insurance Act, the particulars given in the insurance contract should be followed to the letter. If this is not followed, the insurer is relieved of his liability at the same time. Thus we can say that in case of breach of assurance in the contract of insurance, the insurer may consider the contract to be void.

( iii ) Exception – The validity of the contract will not be affected even if there is a breach of assurance in the insurance contract –

- When the insurer waives the assurance.

- When the implied assurance is not mentioned in the Act. For example, the assurances implied in any insurance other than marine insurance are not considered valid.

- When the assurance itself is declared invalid. This may be due to a change in any law or due to a new rule.

- According to section 45 of the Insurance Act of India, if 2 years have elapsed since the contract of life insurance and there is a breach of assurance due to ignorance, then the insurer cannot break the contract on the ground of breach of assurance.

(iv) Principle of Indemnity or Loss Protection – In general terms, insurance means to compensate or indemnify the losses, that is, the system of insurance cannot be used to make profit. This is broadly called the principle of compensation. The amount paid by way of an insurance claim cannot exceed the amount of the loss incurred. After the loss occurs, the insurer is placed in exactly the same financial position as it was before the loss and not In the best case .

According to Justice Brett – “The indemnity principle is that the insured can cover his actual loss under the contract of insurance but can never get more than the actual loss. This is the basic principle of insurance.”

There is a difference between indemnity and insurable interest. Is stiff. It shows the movement of the insured in the subject matter of insurance i.e. the insured, hence the claim amount cannot exceed the interest limit. In case of life insurance, since the insurable interest in his own life is assumed to be unlimited and the value of life cannot be arrived at in monetary terms, the principle of indemnity does not apply here. Therefore, after the expiry of a certain period in life insurance, the insured has the right to receive a certain sum of money, on the death of the insured, his legal heir has the right to receive this amount of insurance.

(i) Characteristics of Indemnity Theory – The following are the characteristics and essential condition of the principle of indemnity .

- The insured can get the indemnity done only under the insurance contract.

- For indemnity the insured must have an insurable interest in the subject matter of insurance.

- The amount of compensation shall in no case exceed the sum insured i.e. the amount of compensation shall be equal to the actual damage.

- The insured has to prove that the amount he is claiming is his actual monetary loss.

- It is difficult to make monetary estimates of loss of life, so this principle may not be applicable in life insurance and personal accident insurance.

- When the indemnity is paid by the insurer to the insured, the principle of substitution applies.

- The insured is not entitled to receive any benefit under the guise of compensation.

(II) Amendment in the indemnity principle –

In fire and marine insurance, only compensation can be done, no benefit can be obtained, but the principle is being adopted in a modified form as per practical requirement. Eg:

- In practice, the insured suffers some unrealized losses along with actual losses. Therefore, nowadays a provision is also made for the compensation of unrealized losses in the insured. For example, restoration insurance is also done along with the insurance to cover the actual losses of the factory.

- Nowadays, the compensation for the consequential losses is also insured. As a result, along with meeting the actual loss, the profits that could have been made if the factory was in operation are also compensated.

- Nowadays appraised insurance papers are also issued. Under this, in case of damage to the insured, the entire amount predetermined in the insured is paid, even if the loss is less. It is clear from the above examples that some practical changes have started taking place in the traditional theory of compensation.

(iii) Methods of Compensation – There are many methods of compensation but the following are the prevailing methods.

- Cash payment – After the assessment of the damage, it is paid in cash. Generally this method is adopted where the subject matter cannot be repaired, replaced or reconstructed.

- Repair method – This method can be adopted only when there is partial wear and tear in the subject matter. The insurer takes measures to bring the subject matter back to its old condition by getting it repaired. This method is generally adopted in motor insurance.

- Replacement Method – In this method, the insurer promises to give almost the same article in case of damage to the insured subject.

- Restoration method – This method is usually adopted in relation to fixed assets. When the property is so damaged or destroyed that it cannot be repaired, a promise is made to rebuild the damaged old property with almost the same subject matter.

For example, in fire insurance, this method is generally adopted in case of complete destruction of the property.

(iv) Importance of Indemnity Principle – This principle is important in insurance contracts for the following reasons.

- Validity of insurance contract – By the implementation of this principle, the validity of the insurance contract remains, otherwise it would have been like a gambling contract and would also be against public policy.

- Reduction in Insurance Premium – Due to the application of this principle, the insured will have to pay less premium in future. Because when people adopt more vigilance then the loss will be less. The insurer will also reduce the premium rates thereby reducing the premium r to the insured.

- Growth of insurance business – With the application of the principle, both the insured and the insurer will make efforts in the direction of minimizing the loss. This will reduce the premium rates, which will definitely increase the insurance business as well.

- Protection of public interest – This principle does not give an opportunity to the insured to earn profit due to injury. Therefore, efforts are made to protect the insured property properly and the destruction of valuable national property can be prevented.

- Protection from non-social activities – In the absence of the principle, corrupt and immoral persons would deliberately damage the insured subject and collect arbitrary amount from the insurance companies.

- Savings from over-insurance and under-insurance – due to the application of the principle of indemnity, only the actual damage is compensated. Therefore, people insure neither more nor less of the property, but they only get the real value of the property insured.

(v) Principle of substitution – According to the principle of substitution, after the insurer has compensated the insured, all rights against the third parties of the insured are transferred to the insurer. In this way, after paying the indemnity, all those statutory rights against third parties are obtained which the insured enjoys.

According to Federation of Insurance Institutes Mumbai :- “Replacement is the transfer of rights and remedies of the insured to the insurer who has indemnified the loss of the insured.”

This principle is called subsidiary principle of indemnity principle. According to the principle, when the insured is indemnified, the insurer sues the insured in place of the insured and he gets all the rights of the insured. In this way, the replacement of the insured by the insurer is called the principle of substitution. This principle applies only to indemnity contracts.

Example- ‘A’ has got fire insurance of his shop and if the shop catches fire due to the carelessness of neighbor ‘B’, then the insurance company is entitled to take action against neighbor ‘B’ after compensating ‘A’. becomes .

(i) The condition of the application of the principle of substitution-

The characteristics, condition or limitations of the principle of substitution are as follows.

- This principle applies only to indemnity contracts.

- The principle of substitution automatically applies. Therefore, it is not necessary to have any condition in the insurance contract.

- This principle is applicable only after the insurer has compensated the insured, but in case of explicit condition, the insurer can exercise this right even earlier.

- While exercising the right of restitution, the insurer has to use the name of the insured only.

- In no case can the insurer take more rights than the rights of the insured.

- If the insurer receives the damage amount more than the amount paid for any reason, then the insured will have the right on that amount.

- When the insured is indemnified for the full value, the insurer has the right over the damaged article.

- The right of restitution is available only if the indemnity is under statutory liability, if the insurer indemnifies out of courtesy or compassion, then he cannot recover compensation from the third party.

- You can also relinquish the right of replacement by mutual contract.

(ii) Importance of Substitution Theory – The importance of the theory can be understood on the basis of the following points:

- In the absence of a supporting principle in the implementation of the indemnity principle, the insured, as well as the person responsible for the loss, will receive the amount of loss, which is similar in nature to gambling, making profit from insurance is contrary to the indemnity principle of insurance.

- Receipt of damage from the guilty party If the insured cannot get the compensation from the guilty third party again, then there will be another defect that the guilty third party will be saved from his liability. Therefore, it is necessary to get the right of the insurance company to present the suit under the substitution principle.

- Reduction in the liability of the insurer By obtaining the right of replacement against the guilty third party, the liability of the insurer is reduced.

VI. Principle of Contribution –

The principle of contribution is applicable in indemnity insurance contracts. The principle of contribution states that if any insured gets the same subject matter insured by two or more insurers, then the liability of indemnity on the damage of that subject matter will be on all the insurers in proportion to the amount of the insureds issued by them. shall be liable to provide only the amount of total damage equal to the “actual indemnity”. The insured has the right to recover the entire amount from any one insurer, but in this case that insurer gets the right to receive the contribution of other insurers.

(i) Conditions of application of the principle of contribution –

- There should be only one person insured.

- The subject matter and risk of all the insured should be same.

- The insured should be the same in all the papers.

- The damage should be within the insurance period.

- The principle of contribution applies only to indemnity insurance contracts and not to life insurance.

- The insured must be legally enforceable.

- The principle of contribution is also applicable in case of double insurance and reinsurance.

(ii) Calculation of contribution –

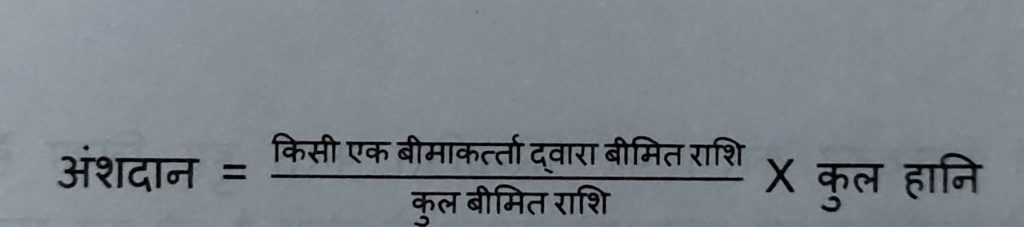

The contribution can be calculated on the basis of the following formula.

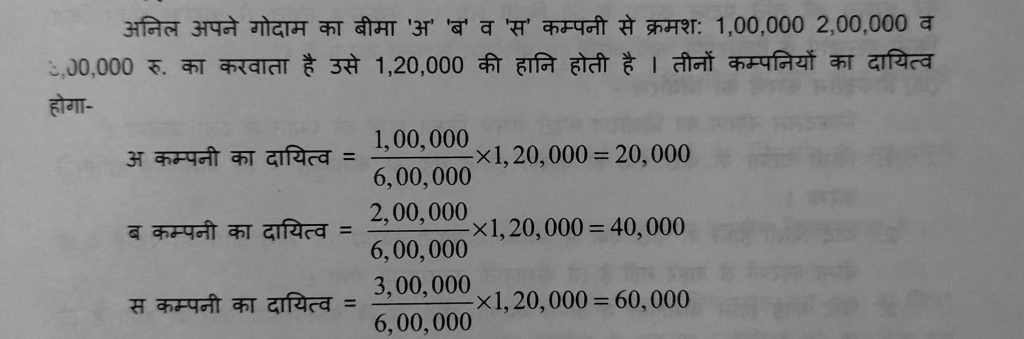

Example:-

If Anil gets the entire sum insured from company C itself, then ‘C’ gets Rs 20,000 from company ‘A’ and ‘B’ respectively. and Rs.40,000. will be entitled to receive

VII. Principle of Mitigation of Damage –

This principle states that in case of damage to the subject matter of insurance, it is the duty of the insured to make all such efforts to protect the insured subject, which in case of non-insurance, a man of common sense would take his own To protect its own goods. When the insured does not make any effort to protect the goods and is negligent which causes damage or further damage, the insured cannot compel the insurer to compensate. But human life is more important than goods, so it is not expected that the party will risk his life to protect the goods.

In short, it can be said that even after getting the insurance done by the insured, he should be alert and alert and should make every effort to minimize the damage. Note that this principle applies only to compensatory insurance contracts and does not apply to life insurance

VIII . Principle of Proximate Cause –

The subject matter insured suffers damages largely due to two reasons.

(i) Insured Reason – In case the subject matter of insurance is damaged due to these reasons, the insurer is bound to indemnify.

(ii) Other reasons- All causes other than the insured’s cause fall under this category and the insured cannot be held liable for the damages arising out of these reasons.

It is important in the principle of proximate cause that the immediate cause is the actual cause of the loss and the insurance company will be liable only if this actual cause is insured and this cause causes some consequence (damage) by triggering a chain of events.

The Privy Council has defined proximate cause in a decision, writing that “proximate cause means such a working and effective cause which gives impetus to the chain of events which starts from a new and independent source without any Produces results by performing efficient work of intervention.”

(III) Determination of proximate cause –

The following points shall be kept in mind while determining the proximate cause.

- If there is only one reason behind an event and that too is insured, then the insurer will indemnify.

- The insurer shall be liable if there are more than one concurrent cause acting together behind a loss that is also not outside the reasons of insurance.

- If any loss is caused by both the insured and other factors being in force, the insurer will not be liable.

- If any loss is caused by both the insured and other factors being in force and that loss can be segregated, the insurer shall be liable for the damage caused by the insured cause.

- The liability of the insurer arises if a loss arises due to the effects of several factors one after the other and the root cause is one of the insured causes.

- The insurer has no liability if a series of uninsured reasons is acting behind a loss. Example: A fire broke out in a cinema hall which destroyed the furniture and a bomb placed in the middle of that furniture exploded, burning the screen of the cinema and other equipment. The same insurance company was not liable to pay because the curtain and other instruments were not burnt due to fire but due to bomb blast.

- If the chain of causes of an event is broken by the emergence of a new and independent cause, the insurer is liable only if the new cause is included in the insured.

(iv) The burden of proving – May be on either the insured or the insurer, so the following rules will apply –

- In case of loss, the insured will have to prove that the loss is due to the reasons insured.

- If the argument of the insurer that the loss is due to uninsured causes, the insurer will have to prove it.

- The insurer shall not be liable if the terms of the insured exclude certain direct or indirect losses from the scope of the insured, even if it is the cause of the insured.

- The insured has to prove that the loss is not caused by uninsured reasons but because of the insured itself.

(v) Importance –

The importance of theory is due to the following reasons.

- The amount of compensation is determined on the basis of the principle of proximate cause only.

- The scope of the insurance contract remains clear and to the extent predetermined.

- The principle is very useful for the mutual interest of both the insured and the insurer.

- Makes a significant contribution to the settlement of differences arising between the parties concerned.

- This principle is most commonly used in marine insurance and fire insurance.

IX. Principle of Co-Operation –

The foundation of insurance is cooperative. It follows the principle of “one for all and all for one.” According to Sir William Beveridge, “insurance is to bear the risks collectively”. “In the normal process of insurance, a group of persons with the same type of risk are formed, they all together form a fund by their contribution. In case of any loss to the members of that fund, his losses are drawn from that accumulated fund. The spirit of this cooperative has been given institutional form at present. Even in ancient times, individuals used to form a voluntary association together and help the at-risk person in times of financial crisis. This basis of cooperative is the main principle of modern insurance. For example, if a business creates a loss fund or creates a depreciation fund, then it is not insurance. In ancient times, there was no institutional form of insurance. They used to collect money when required, but now the institutional framework of insurance has developed through which security is obtained by securing future losses in lieu of fixed premium. That’s why Regal and Miller took It is also written that “Insurance is basically a social organization. In this, a high degree of cooperation is visible for mutual interest. ,

X. Theory of Probability –

This is a practical principle of insurance. The premium rates are determined at present based on the likelihood and intensity of risks in the future. For this mathematical and statistical methods are used.

In probability theory, the probability of occurrence of an event or not is evaluated. Thus, it is believed in probability theory that under normal circumstances, what has happened in the past is likely to happen again in the future, but determining how likely an event is to happen again is very important for the success of insurance. Necessary . On the basis of experiences and astrology, many people have been estimating the possibilities, but the correctness of these methods cannot be trusted in the insurance contract. It can be expressed in formula form as follows.

Probability = Winning times the event occurred / Number of units of the group

Example – In a city there are 50,000 people of age 50 and 50 of them die, then the probability of death in 50 years will be –

Probability of death = 50 / 50000 = .001 and

Survival rate would be 1 – .001 = .999 Similarly,

collagestudy.com

by doing calculations, we find out the probability of risks. Out of all the risks, what is the probability of a particular risk, that particular risk is calculated by dividing all the risks.

With the help of this principle of risk, uncertainty is evaluated and converted into certainty, so that it is known that the total risk occurred and how many such risks will be in the future. On this basis the premium is calculated. The premium should neither be less nor more than the risk so that both the insurer and the insured do not suffer.

Good post!

Thank you for visiting our website, hope you always be our reader.Thank You