- Preface

- History of Auditing and Development of Accounting Business in India

- Standard Audit Practices

- Bookkeeping and Accounting

- Meaning and Definitions of Audit

- Audit Features

- Difference Between Accounting and Audit

- Accounting is a Necessity Whereas Auditing is a Luxury

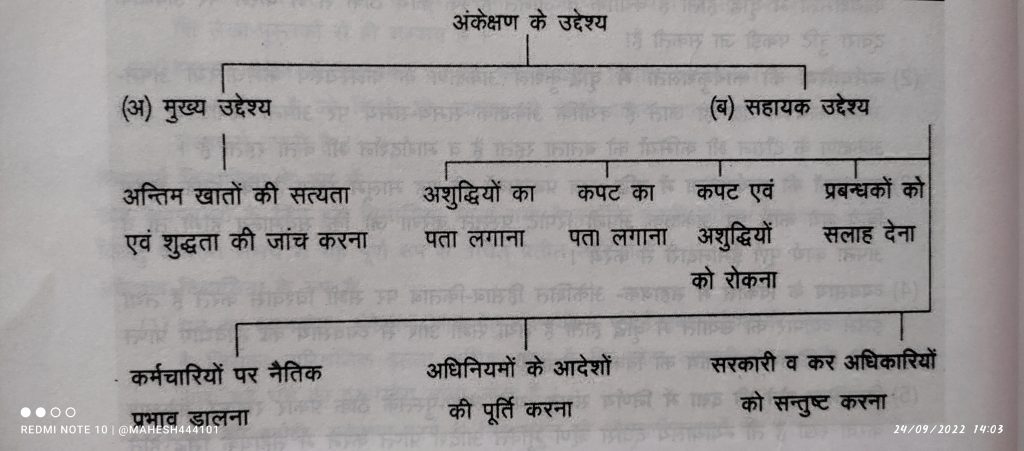

- Audit Objectives

- Inaccuracy and Fraud

- Fundamental Principles Governing Audit

- Scope of Audit

- Types of Audit

- Benefits of Audit

- Limitations of Audit

- Audit Principles, Procedure and Methodology

In ancient times, trade was often done on a very small scale, so the importance and need of accounts was not understood, the year 1494 brought a revolution in the history of accounting business when the double accounting system emerged. The growth of the accounting business actually coincided with the development of the business when the business of doing business as a company started. Along with this, audit also got statutory recognition in the British Companies Act in 1844, initially the company could appoint any of its members as auditors, later on 11 May 1880, the Chartered Accountant Institute was established in Britain to appoint a qualified and independent auditor.

Accounting objectives are successful only when they are reliable. Audit ensures the reliability of accounting statements In today’s economic environment, the role of information and accountability has acquired a more important place than ever before. As a result, an impartial audit of an entity’s financial statements is an important service to investors, creditors and other participants.

Harry E. Evens is of the opinion that the development of the organized form of audit has started with the emergence of the company but it was not the form in which it is seen today. The history of audit and the development of accounting business in India can be divided into the following parts:

- Ancient times – The word audit is made up of audits. The word is derived from the Latin word ‘adair’ which literally means to listen. In the beginning, audit was only about listening. In those days people used to narrate their accounts to a judge who listened and gave his opinion whether the accounts were correct or not. This practice was used in the empires of Greece, Rome etc., which was used for checking public institutions and state books of accounts.

- Fifteenth century and after – After the birth of double accounting system in the year 1494, the progress of accounting also took place as a result of mass production. The rules relating to company audit were given in the rules from 83 to 94 of the first schedule of the Indian Companies Act, 1882, Table ‘A’.

- Indian Companies Legislation. 1913 – Audit of the accounts of public companies in India was made mandatory by the Indian Companies Act, 1913. Earlier, companies used to make audit provisions in their Articles.

- Government Diploma in Accountancy – For the first time among the provincial governments, the Bombay government made arrangements for granting diplomas in the field of accountancy and auditing in the year 1918. Under this, it was necessary for the persons seeking admission in the accounting profession to pass a qualifying examination.And it was mandatory to take three years training under a recognized accountant. The name of this exam was G.D.A (Government Diploma in Accountancy). Such persons who passed the qualifying examination could be appointed as auditors in almost all the provinces of India. The Government of India has granted B. Work . (including Accounts and Audit Subjects) Exam GK. D . a . Declared the qualifying examination as its equivalent and soon this diploma was recognized all over India.

- Rules made by the Central Government – After 1932, the Central Government took this burden on itself. In the same year, the Auditors’ Certificate Rules were made and according to their rules, the title of Registered Accountant (R.A. or Registered Accountant) was given.

- Establishment of the Institute of Chartered Accountants of India.1949 – On the recommendation of the committee constituted under the chairmanship of “Shri C. C. Sai”, the Chartered Accountants Act was passed in April 1949, which came into force on July 1, 1949 and through which the Institute of Chartered Accountants of India was established. The member of this institute is called a qualified auditor which is called Chartered Accountant. Earlier, there are still auditors on the basis of the certificates given by the provincial governments, they are called certified auditors.

- Cost and Works Accountants Bill. In 1958 – 1944, The Institute of Cost and Works Accountants in India was registered as a ‘Guarantee Limited Company’ because the Government of India felt that India should have knowledge of cost accounting as in the Western countries. The Government of India introduced a bill in 1958, the above bill got assent from the President on May 19, 1959 and thus the Institute of Cost and Works Accountants was established as an autonomous institution.

- Cost Accounting Audit in Companies, 1965 – By the Companies (Amendment) Act, 1965, the Central Government has got the right to make it mandatory for any company engaged in industries to conduct cost audit and under this authority, the Central Government has Audit of cost accounts has been made mandatory in some industries with effect from January 1, 1969. for which separate orders are issued.

- International Accounting Movement, 1973 – An International Coordination Committee has been established. The first meeting of this committee was held in Dusseldorf on 26 and 27 April 1973. In this Australia, Canaan, France, Netherlands India, Mexico, UK. Of . Philippines Germany and U. s . a . Representatives of the accounting profession participated. This committee had decided to make Japan as its member at that time.There is also the International Accounting Standards Committee under this committee, which is trying to get the standards implemented by the governments of different countries with the aim of developing standards regarding accounting in the world.

- International Audit Practice Committee 1979 – The International Audit Practice Committee (of which India is also a member) has issued an audit guide to all the member countries. This committee is a part of the International Federation of Accountants (IFAC), an international organization.

International Audit Practices – In the year 1977, the International Federation of Accountants was established with the objective to enable the accounting profession to harmonize with international standards. To achieve this goal, the International Audit and Assurance Standards Board was established, the main function of this board is to develop and develop existing audit practices keeping in mind the high quality, which is in the public interest and can be accepted internationally.

Audit and Assurance Standards Board in India – Institute of Chartered Accountants of India, I. F. A. C. is a member of and is a member of the IFAC . Committed to work in the implementation of Path Audience issued by . In July 2002, the Audit Practices Committee has been converted into Auditing and Assurance Standards Board by the Council of the Institute so that it can come at par with the international trend. An important step has been taken with the objective of bringing desirable transparency in the functioning of Auditing and Assurance Standards Board audit by the participation of representatives of different interest groups and various sections of the society. SAPs (Standard Auditing Practice) have also been renamed as AAs (Auditing and Assurance Standards). So far 34 Audit and Assurance Standards have been issued

According to some scholars, accounting is used in a broad sense. It can have three parts.

- The process of recording transactions, that is, the business part, which may be called bookkeeping.

- The process of creative work, that is, the theoretical part, which can be called accounting.

- The process of critical work, that is, the critical part, which can be called audit.

Earlier, there was no significant difference between the functions of bookkeeping and accounting. But in today’s industrial age both bookkeeping and accounting have become separate functions. Generally the front writing work falls in the field of bookkeeping, accounting and auditing all three.

(a) To do preliminary accounting work and balance –

- To make entries in the journal.

- To carry these entries to the ledger.

- To sum up different accounts in the ledger

- To draw balances of accounts

(b) Summarize and analyze –

- To examine and guide the work of a bookkeeper.

- Preparation of trial balance.

- Preparation of Trading Account and Profit and Loss Account.

- Preparation of balance sheet

- Writing the accounts of corrections and .

(c) Inquiry –

- To check the work of the accountant.

Bookkeeping – As it is clear from the above point (a), bookkeeping is the art of recording business transactions in the journal and ledger, any person with simple ability to keep accounts can do this work with convenience. This work is only to be written mechanically.

Accounting – According to the above point (b), the work of the accountant starts after the work of the bookkeeper. That is why it is said that from where bookkeeping ends, accounting begins from there. In this area, the tasks of drawing balances to preparing final accounts and making necessary corrections and adjustments also come. In short, work is the process of summarizing and analyzing. Summary means trial balance and then its analysis is done by preparing final accounts. The accountant is a well-educated person who is also clever in the work of bookkeeping. His task is to make a logical study by making final accounts.

The definitions of audit according to different authors are as follows:

- F. R. M. D. Paula – “Audit means the examination of the balance sheet and the profit and loss account and the books, accounts and proofs relating thereto so that the auditor can satisfy himself and honestly report that the balance sheet has been prepared and that the business is correct.” and gives the correct position as seen on the basis of the information, explanations and books which he has received.

- Montgomery – “Audit is the systematic examination of the books and accounts of an organization so that the auditor can verify the economic practices of the business and report its results.”

- Lawrence R. Dixie – “Audit is the examination of the accounts of accounts to make it clear that they have been fully and accurately carried out for the respective transactions. Also to ensure that all transactions have been done in an authoritative manner.” ‘

- Spicer and Puggler – ‘Audit is such an examination of several books, accounts and certificates of a business entity, on the basis of which the auditor can say with satisfaction, that on the basis of the explanation and information received by him and which appears in the books. According to him, the balance sheet of the organization shows his financial condition and profit and loss account of the organization in true and correct form. If not, then what are the things he is dissatisfied with and why.

- Joseph Lancaster – “The process of checking, certification and verification is called audit, by which the correctness of the document is revealed. Thus it can be conveniently said that the audit is a research of the form verifies and the books of account from which the books are written.” so that the auditor may submit his report in respect of the balance sheet and other statements made from these books to the persons who have appointed him to report.

- Arthur W. Holmes – Audit is a scientific and systematic examination of the accounts, evidence, legal documents and other details of a public or private institution whose ‘objectives are: (a) to ascertain the accuracy and correctness of the accounts, (v) a certain Properly showing the financial position at date and the position on the basis of accounting principles, and (c) giving an impartial and fair view in respect of these statements. ‘

- Ronald A. Iris – ‘Audit in the present form is a regular and scientific examination of books, testimonies and other economic and legal accounts so as to edit the facts and report in relation to the net income appearing from the profit and loss account and the financial position appearing in the balance sheet. can be given.

- J. R Batleyboy – “Audit is such a special and critical examination of the books of account of a business which is done with the help of the forms and certificates from which they have been prepared. The purpose of this investigation is to find out that Whether the balance sheet and profit and loss account maintained for a certain period of time reveal its correct and correct position.

- A. W. Hanson – Audit is the examination of all the articles in such a way that they can be relied upon and the particulars given by them can also be relied upon. In conclusion on the basis of the above definitions, audit –

- Audit is a specific and critical examination of the books of account of a business entity, which is done by a qualified and impartial person with the help of certificates, forms, information and explanations received from the institution. so that the auditor may, in respect of the accounts maintained for a certain period of time, report whether,

- (a) the balance sheet gives a true and fair view of the financial condition of the institution,

- (b) profits – Whether the loss account gives the actual position of the profit and loss of the organization, and

- (c) whether all the books of account have been prepared in accordance with the rules and are complete.

- Audit is a specific and critical examination of the books of account of a business entity, which is done by a qualified and impartial person with the help of certificates, forms, information and explanations received from the institution. so that the auditor may, in respect of the accounts maintained for a certain period of time, report whether,

- Institution – Audit can be done for any organization (government, non-government, business and non-business).

- Independent person – The audit work should be done by a person who does not have any kind of relationship with business or organization. Only then a fair investigation is possible. Therefore, at present Chartered Accountant has been appointed.

- The nature of the test – The test done by the audit does not only reveal the correctness related to mathematics, but it is an intelligent unbiased test which shows the complete correctness of the account.

- Books of Accounts – In audit, the books of account are checked. The auditor does not have to confine his scope to books only, but also has to know about other statutory books and various facts.

- Verifies and Forms – The books of account are checked on the basis of proofs and forms, if these are not available, their copies are confirmed with scripts.

- Information and Explanation – The basis of verification is the verifies, yet the auditor is not satisfied with the memo verifies, then he can ask for information and explanation to verify the transactions.

- Intelligent – The work of checking done by audit is very important, so this work requires intelligence and cleverness, which is obtained from the experience of this work.

- Purpose of checking – The purpose of checking the books of account is to verify the results of profit and loss account maintained in a certain period and the assets and liabilities shown in the balance sheet on a certain date and to give a certificate of satisfaction. Is . really . The auditor has to express his opinion on the examination of the final accounts.

- Consistency – Under the Indian Companies Act, 1956, some important rules should be kept in mind even while preparing the balance sheet and profit and loss account of the company. Therefore, the auditor of the company has to write in his report whether the balance sheet is in order or not.

- Period – Audit is usually done for the accounts of a financial year or an accounting year. If the accounts of more than one year are audited, then this investigation is called research.

- Result – After checking the accounts, a report has to be given about its correctness and propriety. If the auditor is dissatisfied with anything, it clearly describes it in his report.

| S.R NO. | Basis of Difference | Accounting | Auditing |

|---|---|---|---|

| 1 | Nature | In this, all the work from checking the work of bookkeeping to correction and adjustment is included. | In this, the accounts reverted by the bookkeepers and accountants are checked and the report is given after checking the compliance. |

| 2 | Start | Accounting pays off where bookkeeping ends. | Audit work begins at the end of accounting. |

| 3 | Objective | Its purpose is to analyze the accounts to ascertain the financial position. | Its purpose is to prove the veracity and propriety of the articles. |

| 4 | As Per Rules | In this, the work is done in a systematic way. | In this, apart from audit principles, intelligence and understanding also have to be used. |

| 5 | Supplement | an auditor can become an accountant | An accountant need not be an auditor. |

| 6 | Qualification | Any person proficient in accounting can become an accountant. | For audit work, a person must be a Chartered Accountant. |

| 7 | Report | not submitted by the accountant | The auditor has to complete his work and submit the report. |

| 8 | Origin | Accountancy originated in the year 1494, with this the process of development of double accounting system started. | The work of audit started in India after the year 1913, while the provision of audit was made in the Companies Act. |

| 9 | Workspace | To prepare and collect all the articles and forms. | Scope of audit. In statutory audit, it is done by legislation and in private audit by the employer. |

Accounting as a necessity:- In practical terms, the relation of accounting is essential to keep the business alive and to get prestige in the society.

The following arguments can be given for this.

- In today’s era, it is not possible to know the exact profit or loss of any business without accounting. If the economic condition of the businessman is strong and the financial means are very good, even then selling cheaper than other businessmen will result in higher sales, but only after bankruptcy he will come to know that he has sold the item for less than the cost.

- There are more transactions in business, especially where goods are sold more on credit, it is not possible to remember the names of the debtors, hence accounting is essential.

- Accounting for profit or loss at the end of a certain period is mandatory.

- If the business accounts are kept in a proper manner, the income-expenditure or profit-loss of the current year can be compared with the profit and loss of the previous year.

- Through accounting, the trader becomes aware of his financial position.

- Accounts are of great importance in the assessment of tax. If the accounts are kept according to the rules, then it proves to be very helpful.

- Information about how much money a trader has to pay in total to which persons can be found only from accounting.

- Leaving unprofitable activities, more profit can be earned by starting beneficial activities and if there is a deficiency in efficiency, then knowing their reasons, they can be removed. This work is possible only through accountancy.

- If proper books of account are kept in any business, then the prestige of that business increases.

Accounting also has the following advantages:

- Helpful in determining goodwill – Determination of goodwill is done on the basis of profit and loss of previous years, this work is possible only by accounting.

- Authentication in Court – Books of accounts can be kept in the court as evidence on trade-related disputes.

- For obtaining insolvency order – If the trader is not able to repay the loan due to deteriorating financial condition, then on the basis of the accounts, he can submit a statement of status and a deficiency account.

- License Acquisition Facility – In the import-export business, the license is given to the same business which has been running for a long time. This can be confirmed only from the books of account of the business.

- Facility to get loan – If the trader wants to get loan from financial institutions, then the lender wants to be satisfied with the financial condition of the institution before giving loan, which is possible only from the books of account.

- Helpful in selling business – The value of the business is the basis of the economic condition of the business, which is the basis while selling any business. From this point of view accounting is necessary.

Accounting as a luxury: – It has been considered a luxury for small businessmen because they have limited needs, but at the present time it does not seem completely appropriate.

Auditing as a luxury :-

- Misuse of money – A qualified chartered accountant is required for audit work whose remuneration is so high that the small trader cannot afford, so it is considered a misuse of money.

- Waste of labor – Many formalities have to be fulfilled for audit work. For example, keeping the certificates in date wise order, making lists of creditors and debtors, keeping the books of account in order, etc. In this, a lot of power of the small trader is wasted.

- Fulfillment of audit – The main advantage of auditing is the knowledge of the correctness of accounting, which is automatically known to small businessmen, whereas in big business it is possible only after audit. Another advantage of auditing is the detection of fraud. Still, in the accounts, frauds remain hidden, which the auditor cannot detect in spite of proper cleverness and caution. Hence the audit is meaningless.

- Decreased efficiency of employees – Due to repeated demands of clarifications and information by the audit, the work of the employees is hampered, which leads to reduction in efficiency.

- Pretense of prestige – Some small businessmen do audit work for the purpose of increasing the prestige of their business, which is not fair in any way.

- Time taken – Audit work takes more time, because the audit work is done according to a prescribed method. It is not worth wasting so much time for small business.

On the basis of above facts we can say that auditing is a luxury in small business but it would be wrong to call auditing a luxury for all businesses. In small organizations where there are one or two employees and the work of accounting is looked after by the owner sole trader or partner, therefore audit is not necessary, but in big business it is beneficial and very necessary, not a luxury.

Lack of luxury of audit :-

- Increase in the efficiency of the employees – As a result of getting the audit done, the efficiency of the employee increases because they know that the error can be caught by the auditor if the work is not done properly.

- Increase in the efficiency of the employees – As a result of efficient audit, the employees become efficient in their own work because the auditor keeps on pointing out the deficiencies in his report from time to time and also during the audit.

- Increase in the efficiency of the managers – When the managers know that the auditor will submit his report on the work done by him, which will be acceptable, then he will do his work with complete honesty.

- Helpful in the development of business – Everyone believes in the audited accounts and this increases the reputation of the business and the business gets facilities from all sides, which leads to the development of the business.

- Decision possible in case of insolvency – If the audit is done by keeping the books of account properly, then it proves helpful in getting the discharge order by the court. It may take longer in the absence of this.

- Helpful in planning the future – The manager makes a comparative study on the basis of the closing accounts of several years and sees how the efficiency can be increased.

- Increase in the efficiency of the plant and machine – From the audit of cost accounts, it is known that how much efficiency of the machines is there and due to which reasons the full functionality of the machines is not being used. By knowing these reasons, the efficiency can be increased.

Compulsory of Audit:- Auditing affects efficiency, so it cannot be called a luxury. It is mandatory in the following cases :

- Compulsory of Company Audit

- For Co-operative Societies.

- Audit Compulsory for Trusts

- Government Corporations and Government Departments

- Firms under Income Tax Act

- Compulsory under Income Tax Act in sole business.

Thus it would not be entirely true to say that accounting is essential and auditing is a luxury. Sometimes accounting is also a luxury in small business while it is mandatory for large businesses. But still accounting and audit are two sides of the same coin. If there is no accounting, then whose audit will be done? and accounting alone has no credibility to its veracity

Meaning and types: Making errors is a part of human nature, the main purpose of audit is also to detect and prevent inaccuracy and embezzlement (fraud).

(a) Impurities – The main errors are as follows:

- Theoretical errors,

- Basic errors,

- Repetitive errors,

- Accounting errors,

- Compensatory errors.

Reconciliation of the accounts of the books with the previous year, finding out the amount of difference, checking of trial balance etc. can be adopted.

(b) Fraud or embezzlement – errors that have been carefully planned and carefully done may be of the following types:

Commercial fraud – which are often committed without the consent of the owner of the business such as embezzlement of goods, Embezzlement, embezzlement of assets, embezzlement of labor, embezzlement of facilities etc. Whereas, with the consent of the owner of the business, misappropriation of accounts which are done with the aim of increasing or reducing the actual profit, often river institutions willfully reduce or increase the value of their shares through window dressing. Hisan manipulates the book to make Chi match the bank’s requirement for taking loan.

difference between inaccuracy and fraud:-

| S.R. NO. | Basis of Difference | Inaccuracy | Fraud |

|---|---|---|---|

| 1 | Knowledge | The person who makes mistakes does not notice that a mistake has been made. | it is done intentionally |

| 2 | Intention | Everyone wishes that he should not be impure | The embezzler commits fraud with a predetermined intention and tries not to be caught. |

| 3 | Planning | In this, plans are made in such a way that the chances of mistake are very less. | In this, work is done by planning embezzlement. |

| 4 | Cause | Inaccuracy is caused by carelessness or inattention. | Fraud or embezzlement is carefully considered. |

| 5 | Determination | Routine checks are mostly proven. | It is very difficult to catch embezzlement as it is done very intelligently and systematically. |

| 6 | Intensity of Crime | Making a mistake is not a crime if it is done even after due care. Because man is a guilty person. | Embezzlement with fraudulent intent is an offense which is unforgivable. |

| 7 | Result | The consequences of mistakes are not fixed, it may or may not lead to profit or loss. | In this there is loss to one side and gain to the other side. |

Condition of audit:-

If the auditor has exercised such care, skill and intelligence in his work as was possible under those circumstances and has made all the effort which was absolutely necessary to find out the defects. If still unable to detect the fraud, the auditor cannot be held liable. Audit work never means that the auditor has insured errors and embezzlement, nor does he guarantee that all inaccuracies and embezzlement will be detected. He is only expected to do his work with due care and tact.

The following case is described in this regard:

- The Kingston Cotton Mills Case (1896)

- Use of reasonable care and skill – The auditor is expected to do his work with due care and tact. How much caution and tact should be there in any matter. It depends on the circumstances .

- It is not the duty of the auditor to be suspicious – he is not to do his work with the presumption that something must be wrong in the accounts. The position of the auditor is like that of a guard dog and not that of a hunting dog. The auditor has the right to consider the employees of the business to be honest.

- The auditor is not responsible for the misappropriation and fraud committed by the higher officials in a systematic manner – sometimes the auditor cannot catch the fraud even in suspicious circumstances, then if under normal circumstances the higher The auditor will not be responsible for embezzlement done by the officials with care and tact.

- The auditor shall do his work honestly – It is the duty of the auditor to do his work honestly and not to certify things for which he is not satisfied with himself, and to verify the facts which he certifies with due care and take.

2. The London and General Bank Case :

Auditor does not guarantee accuracy – the auditor is a termite, he does not guarantee that the organization’s books of account, profit and loss account and balance sheet are showing true and proper condition, he also does not guarantee that the balance sheet As per the books of the company are fine. The Institute of Chartered Accountants of our country has explained the following in the audit process statement:

The object of audit is not to reveal embezzlement and irregularities as per the Companies Act, but it naturally becomes apparent during the course of audit. Similarly, the auditor reveals the false statements of the administration, but it is not always possible to do so. The auditor’s responsibility in detecting fraud arises only when he has been negligent.

In AAS-1, the basic principles which are related to the professional qualities of the auditor and which are essential to be followed while conducting the audit. AAS – 1 consists of the following basic principles:

- Kindness, objectivity and objectivity.

- Confidentiality,

- Tact and efficiency

- He is responsible for the work performed by others.

- Collection of audit evidence

- Action planning

- Knowledge of accounting system and internal control system

- Audit findings and reports.

The auditor should review and assess the results drawn from the audit evidence obtained and duly review the results obtained as a basis for expressing his opinion on the financial information.

This review and evaluation determine whether:

- The financial information has been prepared in accordance with such acceptable accounting policies. Which have been implemented consistently?

- Does the financial information comply with relevant rules and regulations?

- Wherever applicable there has been an adequate expression of all material matters relating to the proper presentation of financial information having regard to statutory assumptions?

The audit report should contain a clearly written expression of opinion on the financial information.

It has been told in AAS-2 “Objective & Scope of the Audit of Financial statement” that the auditor’s area is determined keeping in mind the appointment conditions of the auditor, prevailing legislation’s etc. The reliability and adequacy of accounting records and other information should be checked using a variety of methods to form an opinion on the financial statements. To do this, the auditor follows such procedures as to enable him to believe that the financial statements present a true and fair view of the financial position and operating results of an enterprise.

The auditor, by his professional experience and judgmental ability, sets certain criteria of investigation, while doing so, he cannot be expected to work outside his area of competence. The auditor starts the work by setting limits to his work, there are two such limits: wide limit, deep limit In the wide range, the auditor decides how many transactions to audit, while in the deep limit it decides which transactions. I will go deeply and how deeply I have to investigate.

- Compulsory audit under law:

- Companies covered under the Companies Act 1958

- Companies covered under Banking Act 1949

- Companies covered under Electricity Supply Act 1948

- Companies under Co-operative Societies Act 1912

- Registered public or religious endeavors

- Established under special Acts passed by Parliament or Legislative Assembly Corporation

- Special powers under various sections of the Income Tax Act 1961

- Audit of Government Company (under section 619)

- Special Audit (Section 233A)

- Voluntary Audit:

- Sole Proprietor

- Partnership Society

- Joint Hindu Family

- Audit of Educational Institutions, Clubs etc.

- Private Trust,

- From practical point of view:

- Ongoing Audit

- Periodic Audit

- Internal Audit

- Interim Audit

- Independent Audit

- Cost Audit

- Management Audit

- Proficiency Audit

- Proprietary Audit

- Performance Audit

- To conduct own business

- Heck the economic condition

- Detect inaccuracies and frauds

- Get credit conveniently

- Enhance credit

- Give advice for efficient conduct of business

- Moral pressure on employees

- For bosses

- A sole trader to get a certificate of good work

- To have reliable accounts in trust

- To have control over the directors in the company

- To help the firm when audited.

- Others

- Settle business disputes.

- Helpful in taking Government grants and licenses etc.

- Helpful for tax authorities

- Useful for creditors

- Recognition by court

- Helpful in settlement of business damage claims

The techniques of audit are such that it suffers from various inherent limitations. Therefore, it is important for an auditor to understand these inherent limitations, because it is only with this understanding that clarity will be gained about the overall objectives of the audit.

The limitations are as follows:

- The entire audit methodology generally depends on the existence of an effective system of internal control.

- There is no complete certification of the integrity of the employees.

- Audit does not guarantee 100% accuracy.

- It is not possible to catch all embezzlement.

- The auditor’s job is only to express an opinion.

- The auditor does not attest to the justification of the transactions.

Principle means a fundamental fact, a fundamental law. The principles of audit are the basic truths that give knowledge of the objectives of audit and the ways in which these can be achieved. The Institute of Chartered Accountants has started this further initiative by issuing audit and assurance criteria.

Audit Process : It includes all those tasks which are followed during any investigation under audit principles, activities are decided according to the audit criteria.

Audit Methodology: It includes the measures which are adopted to check the correctness of the transactions written in the books of accounts by collecting them in the form of evidence necessary for audit. It includes physical examination, confirmation, recalculation, verification of original forms, matching of records, examination of supporting records, inquiry, sequential checking, correlating an item with relevant information, analysis of financial statements, etc. There is a close relationship between auditing method and procedure. The audit process is followed by planning on the basis of audit principles and auditor adopts methods to obtain evidence/evidence. Due to this the accuracy of the articles can be verified.