Meaning and definitions of reputation,

Reputation is an invisible asset that cannot be seen, only felt. It is easy to describe. But its definition is difficult to give in certain words, yet some scholars have tried to define it, which is as follows:

According to Spicer and Pegler, fame is that which arises from the prestige, relationship and other benefits received by the business. Due to which the business earns more profit than the normal expected return on capital employed in its net tangible assets.

Moriro has defined goodwill and said that goodwill is the present value of an organization’s expected profits.

Is . Profits more than normal profits are earned only because of some invisible asset working in that business in the form of goodwill. In this way, it can be said that the business in which there is loss or only normal profits are being hidden, then goodwill does not exist in that business. According to accounting, the existence of goodwill in a business can be checked on the following two grounds –

1. Is the profit rate of the business higher than the normal rate? ,

2. Are the net assets of the business more than the capital employed in it?

If the answer to both these questions is in the affirmative, it means that there is good reputation in the business.

Factors Affecting Reputation

All the factors affecting the profit of business also affect the goodwill because goodwill depends on the earning capacity, the following elements are

(1) Place of business

(2) Location of business

(3) Nature of business

(4) Business Period of operation

(5) Managerial efficiency

(6) Favorable government approach

(7) Effective advertising

(8) Good labor relations

(9) Participation in social work.

(10) The amount of risk etc.

Need for Reputation Appraisal

Valuation of goodwill means to measure the success, fame and fortune of the business in monetary form, without monetary measurement it is not possible to account for it. By the way, the need for evaluation depends on the nature of the organization, which is mainly as follows –

1. In case of a stand-alone business.

(i) On selling the business.

(ii) On making another person a partner in a sole business

(iii) On nationalization of business,

2. In the case of a partnership firm

(i) on the admission of a new partner

(ii) on the retirement or death of the partner

(iii) on the change in the profit-loss ratio of the partners

(iv) on the sale of the business of the firm

(v) On amalgamation of firms

(vi) on the conversion of the firm into a company,

3. in the case of a company

(i) on sale of the business

(ii) on amalgamation or amalgamation of the company

(iii) on valuation of shares for a specific purpose

(iv) other On purchase of shares to establish control over the company

(v) On acquisition of business under the scheme mandated by the government.

Basis of Valuation of Goodwill

Valuation of Goodwill:-

(1) Actual Average Profit

(2) Super profit,

so it is necessary to calculate them first.

(1) Actual Average Profit:- It is also called as sustainable benefit in the future. First of all, the net profit of the previous years (usually 3 or 5 years) is considered as the basis and after that any abnormality in any particular year should be adjusted such as.

(i) extraordinary loss or expense such as loss from sale of fixed assets, Loss due to fire, loss on revaluation of fixed assets etc. will be added to the profit of the respective year.

(ii) Extraordinary profit or income (such as profit from sale of fixed assets, profit on revaluation, income of non-trading investments, dividend on preference share, etc.) should be deducted .

simple average profit after the above adjustment, or Weighted Average Profit When profits have a tendency to Increase If necessary, the following adjustments should be made in such average profit and the profit obtained after that is called the actual average profit.

A. Expenses that were being incurred in the present but will not arise in future will be added.

B. Such income which will not be there in future, they will be deducted.

C. Such expenses which are likely to be incurred in future, they will be reduced.

D. Such present income which is not likely to be sustained in future shall also be deducted.

E. In case of solitary business, his fair remuneration will also be reduced when the owner conducts the business. Similarly, in the case of a partnership firm, if the partners run the firm, their fair remuneration will also be deducted.

Note:- Calculation of actual average profits in case of company:- For this, after adjusting abnormal loss or profit in the profits of the first year and the income of non-business investments, then after subtracting it, the average of the profits will be found. Taxes should be deducted from it and then the dividend of preference shares (Non-Participated) should also be deducted. The profit received after this is the actual average profit.

It can be explained as follows.

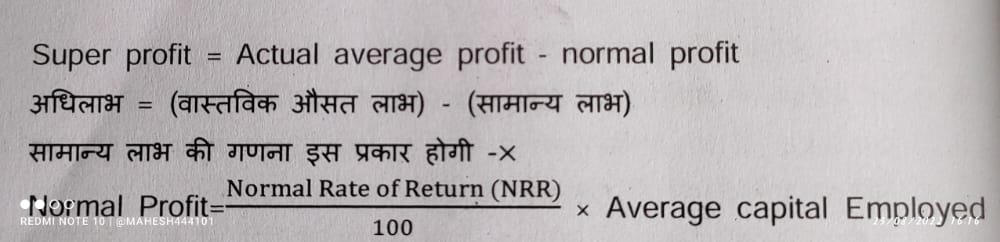

(2) Super Profit:- Super profit is the excess of the actual average profits of the business over its normal profits. In formula form it can be written as,

For this,the calculation of Average Capital Employed-First off all, the capital employed at the end of the year will be determined as follows.

1. Fixed assets to be acquired at market value, if not given, at written down value.

2. From the current assets, the planning made on them should be deducted. And intangible assets should be included only if they have realizable value, otherwise if goodwill is bought (at cost), then it should not be included in assets otherwise.

3. Artificial assets like initial expenses, underwriting commission, discount on issue of shares and debentures etc. should not be included in the assets.

Similarly, non-business investments should also not be included in the assets. In the case of a company, the preference share capital should also be deducted. ie,

If capital is not given in question,the average capital employed will be calulated as,

Average capital employed = Capital employed at the end of year-1/2 current year profit after tax.

Note: If some clear information about capital employed is not given in the question, then average capital employed should be used only. If it is clearly stated in the question that the last invested capital should be taken as the basis, then the last appropriated should be taken.

Normal Rate of Return – Generally given in this question, which is normally the prevailing interest rate in the market.

Thus from the above discussion the two bases of valuation of goodwill are known;- (1) Actual Average Profit

(ii) Super profit.